Rebalance makes investing as easy as it should be. It presents a quick, simple way to take advantage of daily stock market volatility in managing your retirement savings on your schedule.

Retirement savings accounts primarily offer two types of investments: stock, and 2) fixed income (like bonds and cash). Over time, market changes may cause a portfolio’s investment holdings to stray from its target asset allocation. Portfolio rebalancing involves periodic fund transfers to bring these investments back into alignment with the target allocation. The associated fund transfers between cash and stock index funds result in buying low and selling high -- always a good thing.

Why settle for automated rebalancing commonly offered on a quarterly basis when you can rebalance your retirement savings as often as once a day? With Rebalance, now you can enjoy the returns from rebalancing more frequently.

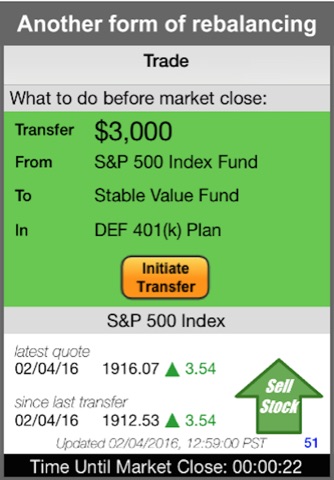

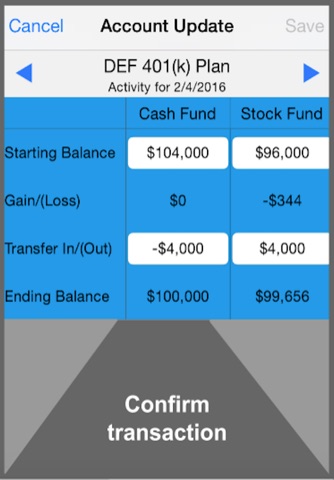

Each day Rebalance offers specific guidance as to the amount, source, and destination for a fund transfer between cash and stock index funds based on current market conditions. These fund transfers do not trigger immediate taxes or direct trading costs.

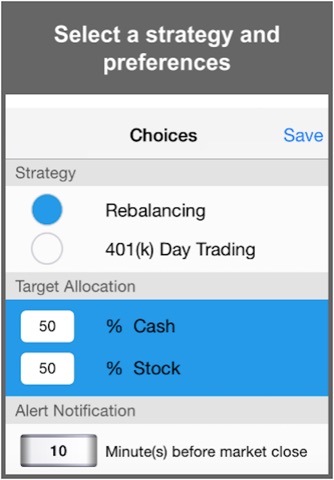

The guidance provided by Rebalance takes into account any user-entered account information and preferences. It offers the flexibility to select from two alternative strategies: 1) time-based rebalancing, or 2) a variation thereof, known as 401(k) day trading.

Rebalance also includes features that allow busy people to rebalance their retirement savings in minutes. For example, it offers a daily alert as a timely reminder to check the Rebalance app for fund transfer guidance before the market close. Its account update feature automatically records the current day’s fund transfer at the tap of a button.

Rebalance is an educational tool designed to assist 401(k), 403(b), 457, and IRA accountholders in managing their retirement savings. Its ease of use lends itself to transform the way, and frequency with which, regular folks rebalance their retirement savings. Rebalance does not provide advice.

Review, rebalance, and repeat. Rebalance makes it easy to review the guidance, rebalance retirement savings, and repeat the process on your schedule.

Quarterly is so yesterday. Rebalance your retirement savings today ... or any day.

Now you can check out Rebalance for FREE for one day. To use this product on an ongoing basis, you must purchase a subscription. The two subscription options currently available are:

- A bi-monthly subscription for $1.99, or

- An annual subscription for $9.99.

Payment will be charged to iTunes Account at confirmation of purchase.

Your subscription automatically renews unless auto-renew is turned off at least 24-hours before the end of the current period.

Your account will be charged for renewal within 24-hours prior to the end of the current period at the then existing subscription price.

No cancellation of the current subscription is allowed during active subscription period.

Subscriptions may be managed by the user and auto-renewal may be turned off by going to the users Account Settings after purchase.